Content

Future laws and regulations manage decide which organizations the official have a tendency to bargain so you can offer services and how, in practice, they will do it. Whatever the case, performing establishments will be required to include totally free account having no minimal harmony standards, deleting a button financial hindrance to get into. To choose a high-focus bank account, take into account the APY given as well as the requirements necessary to earn you to rates — things like the very least put, minimum balance, head deposit quantity, debit card transactions, an such like. You will want to see in case your bank otherwise borrowing partnership also offers a charge-free Automatic teller machine network and you can/otherwise Automatic teller machine reimbursements. Places – finance away from users to help you banking companies you to form the main funding of banking institutions – are generally “gooey,” especially in checking profile and you can low-produce deals accounts one customers are too idle so you can blank out.

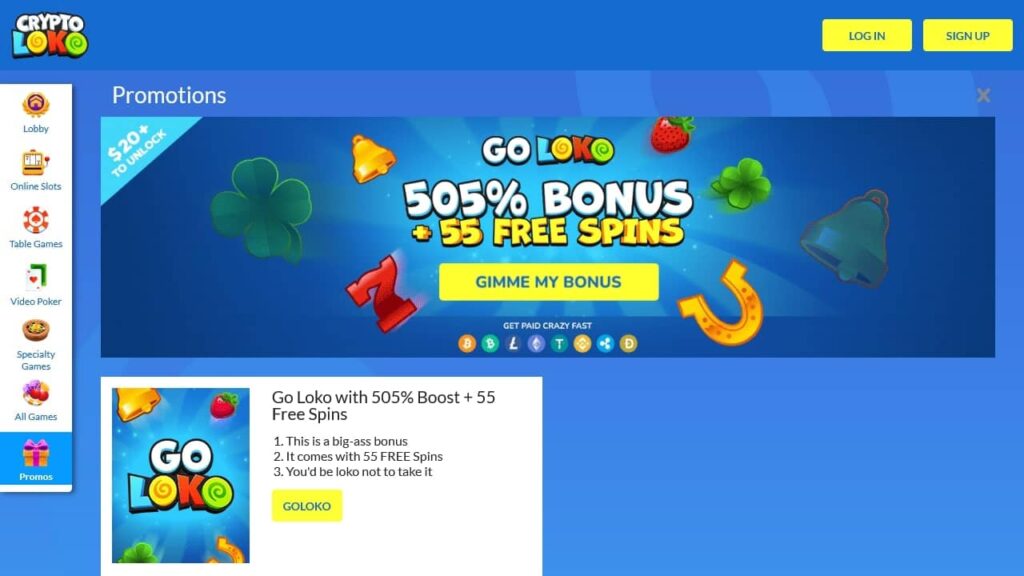

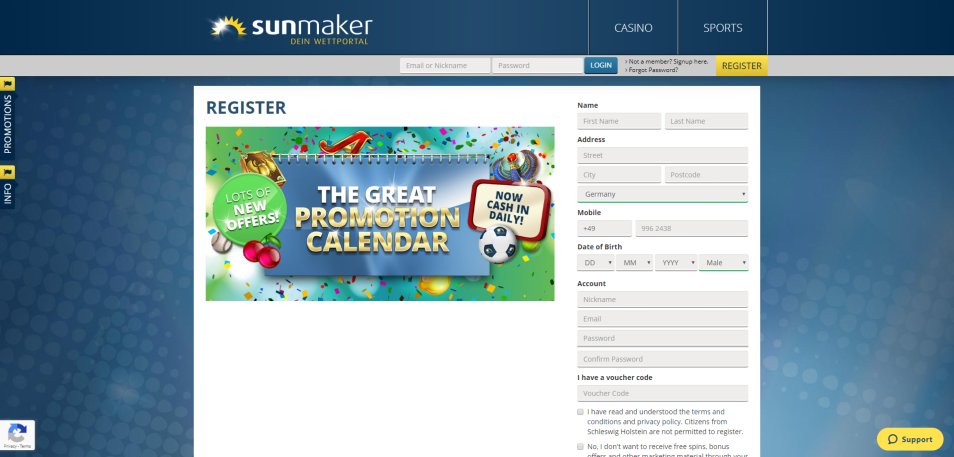

The newest Therapy of step one Deposits: Exactly how Gambling enterprises Interest and you can Maintain People

Various other secret function of all large-produce savings membership is their changeable APY, which means the interest rate is also vary for the market. Since Will get 2024, the newest Provided features yet to lessen rates of interest as it waits for inflation so you can development off to your the dospercent address. If your Given in fact cuts cost on the second half of the season, sure enough, rates of interest to own deals account will almost certainly slip. Remember that the newest “better cost” quoted here are the high across the nation offered prices Investopedia has understood in its everyday rates search to the a huge selection of banking institutions and you may credit unions.

Get specialist information, procedures, information and you can all else you need to optimize your currency, straight to your own email.

Rates background to have Ascending Bank’s checking account

Cds are a kind of checking account the place you earn an excellent fixed interest rate more a predetermined several months, known as a good Video game identity. If you would like more of a reward not to contact your offers, an excellent Video game is read the article going to be a sensible flow. At the conclusion of the phrase, you can get your own unique deposit plus the accumulated interest you made. All of the The united states Financial are a keen Oklahoma-based bank which provides individual and company lending products, in addition to financial, senior years fund, handmade cards and you will house, personal, auto and loans.

As to why Loss Financial?

Following balance alleviated once again, to 2.thirty five trillion after November, with respect to the Given’s month-to-month H.8 banking research put out today. The brand new Irs, and therefore produced the newest announcement on the April 17, didn’t say in the event the stimuli payments will be provided for Virtual assistant beneficiaries. No additional paperwork becomes necessary, for each and every the brand new suggestions from the Internal revenue service. The dimensions of the newest consider usually fall off based on money for individuals who earned more 75,100000 centered on its federal tax go back for 2019 (or its 2018 get back if they have perhaps not recorded yet ,). The fresh commission for people usually shrink from the 5 for each a hundred gained over 75,one hundred thousand.

What exactly is a Cd speed?

Accounts backed and you can provided by the brand new Given was generated obtainable to help you People in the us via a great postal bank operating system where anyone you’ll bank during the nation’s 32,000 stone-and-mortar postoffice metropolitan areas. In reality, in early 20th century, the us run a greatest and safe postal bank system. While it began with 1911, a great Postal Discounts System acceptance all the Americans entry to zero-discount profile during the article workplaces. The system maintained their popularity through the High Depression, whenever social have confidence in private banks, by comparison, eroded.

One noted, you could nevertheless already find savings account giving more 4.5 percent APY. CIBC Financial United states is acknowledged for giving an aggressive give for the the CIBC Agility On line Savings account, and that charge zero monthly provider percentage. During the step one,000, minimal to start so it account is a bit steeper than other account at this listing. Deals and you will MMAs are perfect choices for anyone trying to rescue to have quicker-name wants.

At the same time, gambling enterprises always offer their players with an increase of benefits so they can try a lot more headings. Ben Pringle are an online gambling establishment expert focusing on the new Northern American iGaming world. As the a professional Posts Publisher for Covers, he produces extensive gambling enterprise recommendations, in depth bonus password walkthroughs, as well as in-breadth informative guides to help the newest and you can knowledgeable players obtain the line when gaming on the web. Even after getting a British native, Ben are an expert to your legalization out of casinos on the internet within the the brand new U.S. plus the lingering extension from regulated places in the Canada. Yes, Highest 5 Gambling enterprise is a legal, public casino you to works inside 35 claims. However, this is not accessible to participants inside states where actual-money casinos on the internet are permitted or where legislation do not let sweepstakes playing.

The newest Treasury Department states they needs money to have SSI receiver to time no later on than simply very early Can get. Standard Chartered has low-advertising fixed put cost, nevertheless these hop out far more to be wanted. The conventional Simple Chartered fixed deposit prices had been revised on the April twenty eight, 2023, whilst still being are only merely striking around three percent p.an excellent. UOB’s fixed deposit rates construction is currently flat, with only one unmarried interest away from 3.ten per cent p.a good.

FinanceBuzz can make money once you click on the hyperlinks to the the site to a few of your services offers that people speak about. Pursue Individual Consumer Checking℠ is easily the top options for the the checklist if you’d like improved private financial help but never do have more than 1 million inside the possessions. Morgan Personal Lender is a superb prize-profitable choices that needs you to have at least 10 million within the possessions. Your choice of a bank you may depend in the high part for the the degree of wide range we should perform. I would choose a financial you to caters to super-high-net-well worth people when you yourself have more than 30 million inside the possessions, because it can get pros experienced in handling for example considerable amounts of cash.